Source: Daily Breeze

A strong year of economic growth in the South Bay will likely continue into 2022, Cal State Dominguez Hills experts said Thursday, Oct. 28, with cities coming out of the coronavirus pandemic and emerging industries looking to shape the future of the region.

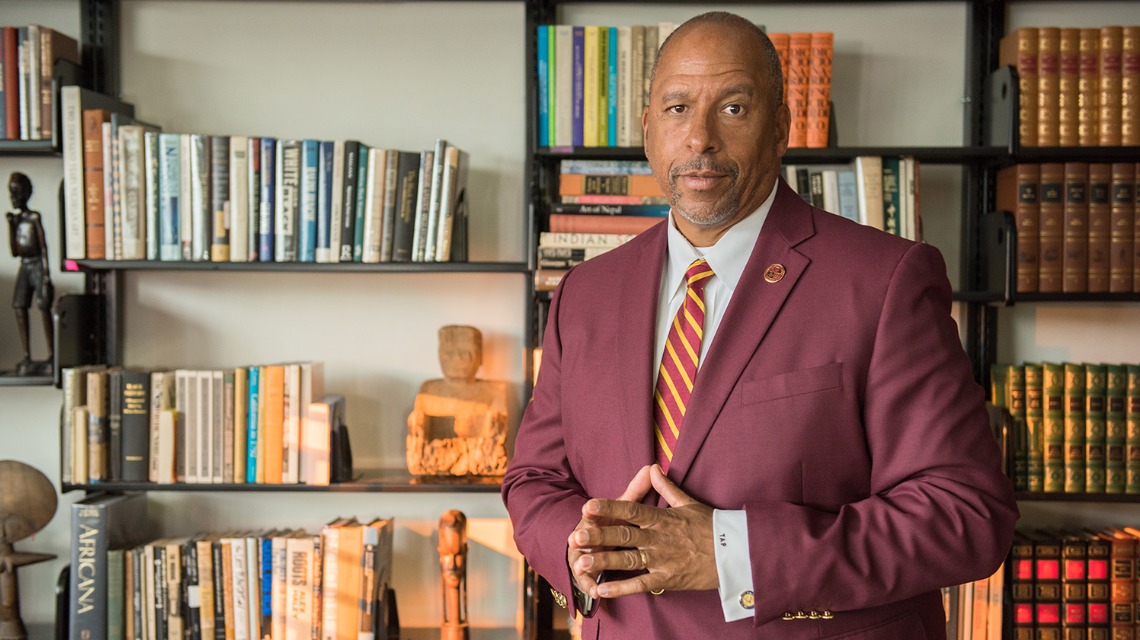

That assessment came from the university’s South Bay Economics Institute, which presented a report assessing the state of the region’s economy and predicting the year ahead. The institute, part of Cal State Dominguez Hills, presented that report during its seventh annual South Bay Economic Forecast & Industry Outlook at the university’s campus, near Carson.

With high vaccination levels and low coronavirus rates, shrinking unemployment, and housing prices at an all-time high, there is plenty to be optimistic about, the report and the panelist’s for Thursday’s presentation said.

“Southern California is doing really well,” said Fynnwin Prager, the institute’s co-director. “And we believe good things are on the horizon for the South Bay.”

Worker shortages have been a concern, especially coming out of the pandemic, but the labor market appears to have largely recovered already, the report said. Many businesses nationwide began rehiring quickly after various government-mandated shutdowns eased. As a result, unemployment rates returned quickly to mid-2010s levels.

California has an unemployment rate of 7.6%. The South Bay’s unemployment rate is 3.4%.

Manufacturing, retail trade, hotels and food services, and health care and social assistance were the major employers in the South Bay pre-pandemic, making up for nearly half of all jobs. But after last year’s stay-at-home orders, employment in all major South Bay industries declined sharply.

From the second quarter of 2019 and the same period last year, employment in the South Bay declined by more than 12%, the report said.

Granted, employment in the South Bay is still below pre-pandemic levels, according to the report. But the number of businesses has continued increase after an initial pandemic-induced decline. And, in some cases, major industries – including the arts; entertainment and recreation; educational services; professional, scientific and technology services; real estate; and the rental and leasing industry – have seen the growth of new businesses accelerate in recent months.

This acceleration, coupled with decreasing unemployment and innovations brought on by the pandemic, the report said, is part of the “creative destruction process,” the innovation-driven process that replaces old production methods with new ones.

Industries in the South Bay, Prager said, are more resilient than before the pandemic thanks to the creative destruction process, which includes such shifts as companies adapting to letting their employees work from home rather than an office.

It will take until June 2023 to reach pre-pandemic levels of employment, said Jose Martinez, the institute’s other co-director. The institute did not provide the South Bay’s current employment data. But Martinez did say the region is “moving twice as fast as” during the Great Recession.

The South Bay’s housing prices, meanwhile, have also followed a similar speedy recovery during the pandemic, Martinez said, outpacing the Great Recession. The region’s coastal cities, in particular, have seen higher housing prices and have had a stronger price recovery since June 2020. The current price range for homes on the coast, the report said, is $2.6 million to $3.2 million, representing a 32% increase since June 2020.

“It’s ironic how real estate was declared non-essential,” Martinez said, alluding to the pandemic-related shutdowns. “Home prices are at an all time high with historically low interest rates.”

Because each industry has been impacted by, and recovered from, the pandemic differently, the trajectories for how each industry will contribute to the economy moving forward will differ, the report said.

But Thursday’s panelists were certain about one thing: industries like aerospace, technology and communication, ecommerce, and health care will steer the regional economy going forward. Those industries include the Air Force Space and Missile Systems Center in El Segundo, and SpaceX in Hawthorne.

But the South Bay’s greatest strength that will guide it forward, according to economists, is its diversity and innovation.

“Cultural diversity can enrich our lives with food, art, and events,” the report said. “Yet businesses benefit substantially too: foreign direct investment supports local workers and city government revenues, and global trade connections reduce business costs and spread risks.”