A student loan debt cancellation plan officially announced by President Biden last month will bring much-needed financial relief to CSUDH students, a handful of whom addressed the program’s impact during a roundtable discussion on Friday, Sept. 9.

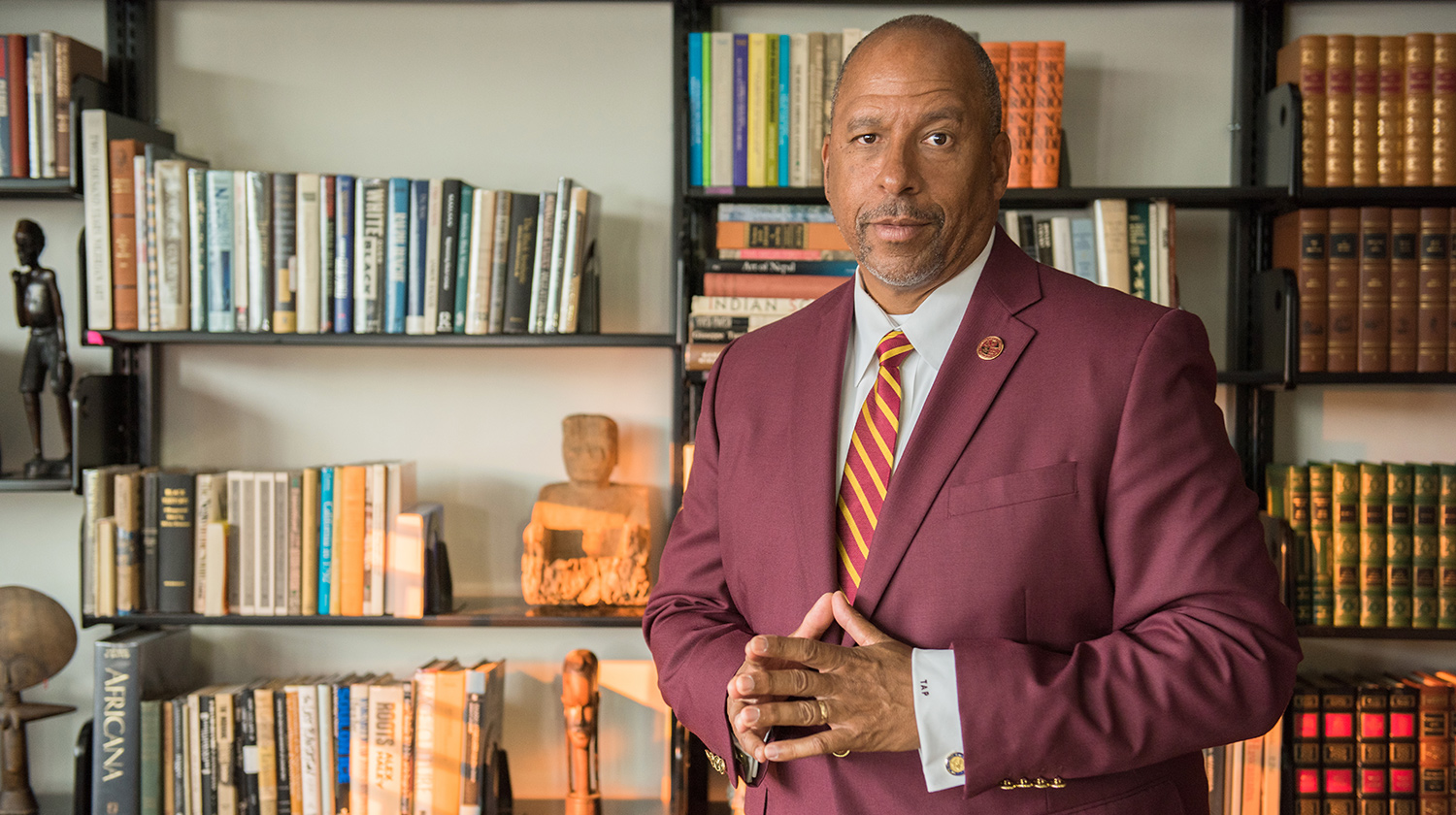

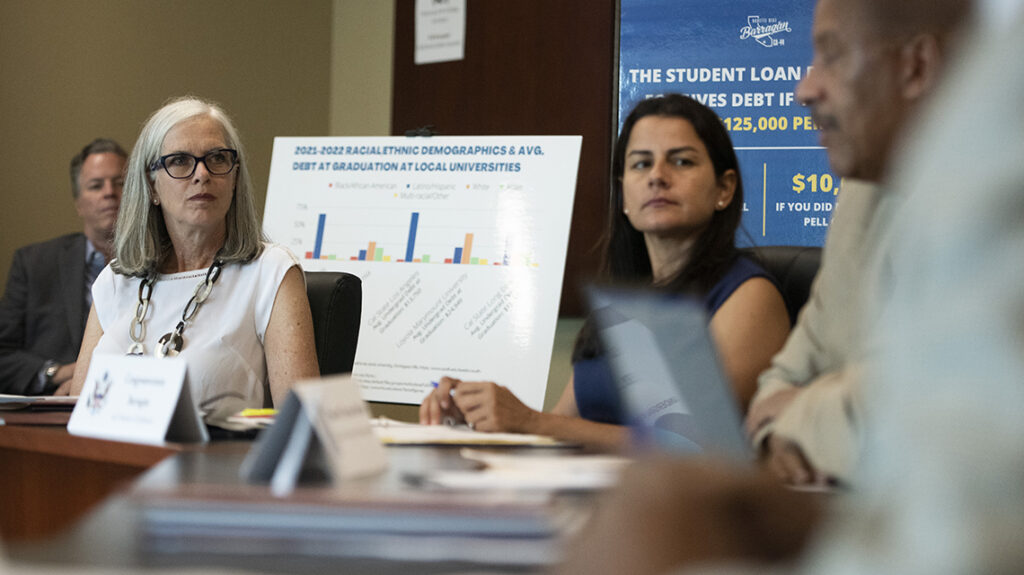

Nanette Barragán from California’s 44th district, and Assistant Speaker of the House Katherine Clark of Massachusetts’ 5th district, met with President Thomas A. Parham and seven current and former CSUDH students to hear their concerns and answer questions about the program.

Skyrocketing tuition rates and the failure of Pell Grants to keep pace often mean that students from low- and middle-income families have few options beyond borrowing money to pay for their education, according to a White House loan relief factsheet outlining the plan.

Students of color, and particularly women, are disproportionately affected by ballooning student debt – a point Parham highlighted while introducing Barragán and Clark.

“If you want to know where the diverse leaders of the nation are coming from, they’re coming from places like our CSUDH. We’re 97 to 89 percent students of color and 68 percent women. So you’re in the right place.”

Clark told the roundtable that loan forgiveness would allow students, particularly female students, to get out from under debt that holds them back from further education, progress on their chosen career path, and the creation of generational wealth crucial to greater educational opportunities for the next generation.

“We know that women are two-thirds of all student debt holders. This is even more so for women of color,” Clark said, adding that half of all Latina borrowers would see their entire debt forgiven under the plan.

Barragán, whose district includes CSUDH and the city of Carson, explained that she took out loans for tuition and to help support a terminally ill parent during her undergraduate studies at UCLA. She incurred even larger amounts as a law student at USC.

“I have about $15,000 left, but I had a lot more than that,” Barragán said, adding that though the challenges might be different for students now, “there are things that I can understand and relate to.”

Karlynn Parker, a 2020 graduate of CSUDH with a degree in film, television, and media, said it’s been difficult to find work, and that the debt forgiveness has given her much-needed peace of mind.

“How am I going to afford to pay my loans, pay my car, food, housing, taking care of my necessities? I feel like this is really a blessing to be able to have this opportunity,” Parker said.

Student debt has been a source of anguish for Kristin MacGuire, a first-generation college student who saw her initial student loans more than double because of poor communication by the servicer about the terms of repayment.

“Up until about seven years ago, I actually felt guilt and shame about how much my debt had ballooned, not understanding that there was a larger issue,” she said. Other students echoed similar themes, noting that student loans are in many instances the first adult responsibility for young people from communities with little or no financial literacy.

Students needed more assistance to improve accessibility to affordable education, Parham said in his concluding remarks. He suggested that Pell Grants should be doubled to keep pace with the rising cost of education. He also said students would benefit from improved early outreach, so they’re better prepared for the rigors of higher education.

“It’s part of the social contract that exists. It’s not just about cost. We’re trying to help students understand this is about an investment,” Parham said.

Barragán told the students that neither she nor Clark were done working on student loan debt relief.

“My hope is that we in Congress can continue to make efforts on this front. When we all do better, our country does better,” Barragán said.