Source: Daily Breeze

While unemployment is expected to increase moderately in the next two years, the South Bay’s economy is will continue weathering challenges and growing, thanks to hyperinflation flattening, the region’s innovative industries and a strong overall labor market.

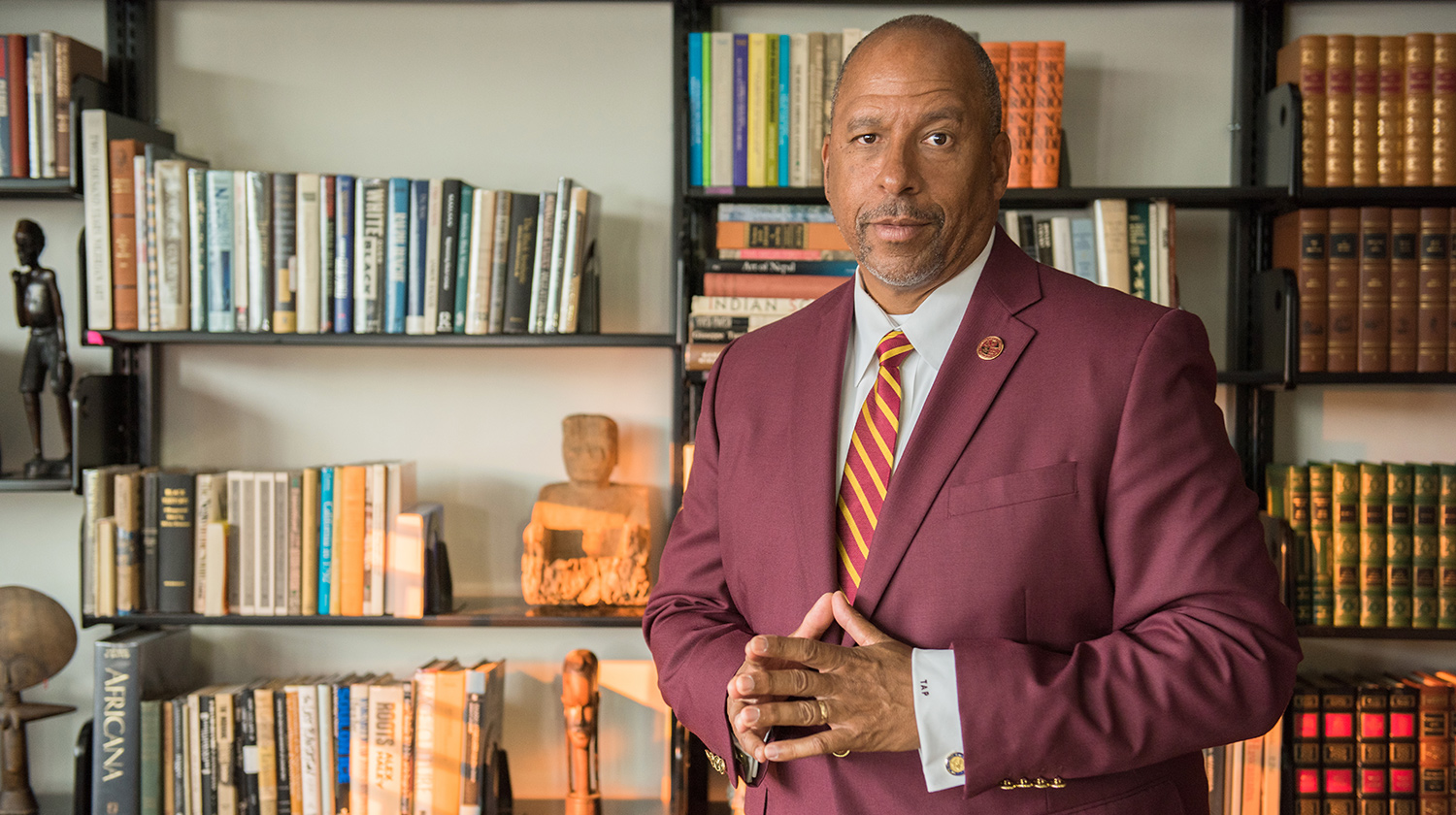

That is according to researchers and economists at Cal State Dominguez Hills, who presented their findings during the ninth annual South Bay Economic Forecast conference this week.

“Somehow, the economy keeps performing well,” Fynnwin Prager, co-director of the university’s South Bay Economics Institute, said during the Thursday, Oct. 26, conference. “That is in spite of really high inflation last year.”

he South Bay region is impacted by many of the same challenges facing the state and national economies. Inflation, for example, appeared to have reduced demand across numerous sectors in the South Bay and the broader Los Angeles area, but US consumer confidence remains high, the economists said.

The high prices of goods, coupled with a tight labor market, has also spurred numerous labor strikes across LA and the nation this summer, with many workers demanding higher wages to make ends meet.

The unemployment rate in California tends to be slightly higher than the United States overall — 4.6% to 3.8% in August — but both LA’s and the South Bay’s employment markets have recovered faster than the rest of the state since COVID-19 hit, the economists said.

This is in part thanks to the region’s diverse and highly educated workforce, its strong start-up and investment culture, the ports, and infrastructure, according to the report, as well as its competitive high-tech industries — which will continue attracting business and household investments.

As such, while the unemployment rate will continue increasing for the next two years, it won’t reach “unmanageable levels,” according to the report. Unemployment in the South Bay has gone up tp 4.8% this year. It’s expected to climb to 5.5% next year and then drop to 5.2% in 2025.

The average unemployment rate across the nation is 3.8%. Economists predicted it will experience a moderate growth over the next two years, to 4.3% in 2024 and 4.4% in 2025.

The real Gross Domestic Product rate, meanwhile, will follow a similar trend. It has grown at a rate of 1.4% this year for the region. It’s expected to jump slightly for the next two years, to 0.7% in 2024 and 2% in 2025.

“It’s really a surprise that the economy is doing so well, and the main source of that is consumer spending,” said Jose N. Martinez, the institute’s other co-director. “Consumers are just spending like crazy, basically. So that’s good news for the economy.”

But inflation has put upward pressure on some industries.

The ports of LA and Long Beach, for example, have been collateral damage. The climb in Federal Reserve interest rates, aimed at curbing high inflation, may be a contributing factor for the decline in manufacturing activity, as well as a drop in orders for U.S. manufacturers.

All of these factors led to a drop in the volume of cargo handled by the twin ports. They have lost 5.9% of the country’s market share in the past decade to East Coast ports, according to the report.

The severe shortage of warehouses that LA County experienced during the pandemic, meanwhile, will likely continue through 2040, authors of the report predicted. They anticipated inventory shortages to appear as early as in the first quarter of 2028.

South Bay’s housing market, though, has continued riding the waves of the economy’s ups and downs.

Home prices have been going up for the last couple of months, Martinez said. They peaked in mid-2022 and came back down for around seven months before climbing up slightly again.

“We suspect that the Federal Reserve will continue, at least in a moderate base, to keep raising interest rates, which is not good news for the housing market overall,” he said. “But, again, this is Southern California, this is California. People love to be here, so we don’t expect any major downturn in the market.”

Most cities and neighborhoods in the region have had fewer house sales from 2022 to 2023, with Wilmington being the hardest hit. But this is directly influenced by that LA neighborhood’s higher growth in house prices, the report said.

In contrast, Inglewood, El Segundo, Carson and Lomita have all experienced jumps in transactions. But housing prices in those cities have all declined from June 2022 to the same month this year.

But there are also reasons for optimism, driven by a growth in new home construction, Martinez said.

“Even though the interest rates are so high, big company constructors (are) actually able to pay or to buy some of those interests down,” he said, “and people are able to afford those homes and buy them.”

Despite some of the challenges, the South Bay has continued to show strong resilience.That’s partially because with hyperinflation flattening, retail and hospitality have returned to pre-pandemic levels this year, the experts said.

The wide variety of companies that call South Bay home is another factor. A total of 5,056 start-ups are headquartered in the region. Together,they have invested more than $350 billion in capital.

The South Bay continues to be a hub for aviation and aerospace companies. The region boasted more than 78 companies and 502 investors in this category.

For the first time, the forecast also highlighted the implications of advancing artificial intelligence. While there are concerns that AI will replace jobs, many companies, including those in the South Bay, have started to use the technology to improve productivity.

More than 20 companies in the region are developing AI, said Jennifer Brodmann, a faculty researcher at the CSUDH institute.

Overall, AI could be good for the economy, Martinez said.

“The key,” he said, “will be to translate those AI and that technology into labor productivity.”