Despite having earned a degree in aeronautical engineering from Cal Tech as a young man and having enjoyed a successful career in the aerospace industry, Philip Johnson was retired and in his 50s when he began attending California State University, Dominguez Hills in the late 1970s. By all accounts, Johnson was an enthusiastic participant in academic pursuits within the CSUDH physics department, where he dedicated himself to both learning everything he could and sharing his own considerable knowledge with others. He earned his bachelor’s degree in physics in 1980.

“Phil was what you might call a renaissance man, well-versed in many fields: literature, philosophy and history,” wrote Keith Lee, former head of the physics department, after Johnson passed away in 1983. “I admired him for his many talents.”

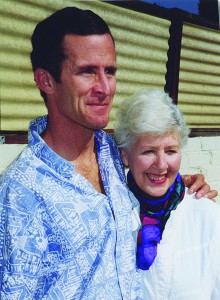

Philip Johnson’s love for Dominguez Hills would become an inspiration to his family.

“That’s the reason the giving started,” said Bruce Johnson, Philip’s son. “When Dad died, my mom gave the university a financial donation to honor him.”

The gift established the Philip Johnson Endowed Scholarship in Physics. His mother, Yvonne Johnson, created a charitable gift annuity at the time of the endowment, and Bruce has recently added a $225,000 gift annuity to the scholarship.

“The gift annuity program worked out really well for my mom. She was in her mid-80s when she started, and she received a high interest rate on her investment,” he said. “It was a good thing for Dominguez Hills and a good thing for my mom.”

And an eternal tribute to his father.

The CSU Dominguez Hills charitable gift annuity program allows the transfer of cash or securities to the university with a minimum gift of $10,000. In return, the university pays the donor, a spouse and any two other named beneficiaries a dependable, fixed income for life. In many cases, the payments are at a percentage rate higher than the rate on investments, and the rate is fixed and will not be affected by the fluctuations of the market.

When Bruce inherited his mother’s house after she passed in 2010, he knew that an endowment similar to the one she established would be a meaningful way to honor her and a smart move for his own future.

“For me, the percentage rate is much better than parking it in a CD that gets less than one percent,” said Bruce, who owns his own gardening business. “I wanted to simplify my life and forget the stress of watching the market go up and down.”

Bruce decided to sell the house and set up a $200,000 gift annuity at CSU Dominguez Hills toward the creation of a music scholarship to honor the role that music played in three generations of his family. His great grandparents, grandmother, and mother, Yvonne, all taught piano; Yvonne continued to strengthen her own talent by taking piano lessons up until her death.

And both Philip and Yvonne were frugal and smart real estate investors “back when you could buy a house in Manhattan Beach for $7,500,” said Bruce. “They bought properties at the right time and invested in the stock market.”

Bruce contemplated giving to other educational institutions with more costly tuitions, but he knew that his gift to CSU Dominguez Hills would make more scholarships available and benefit first-generation college students, like his mother, a naturalized U.S. citizen born in Mexico, who attended Los Angeles City College. He is very pleased that his parents’ legacies will benefit so many, he said.

“It’s giving people a chance, and I like to reward people who have talent and are in financial need. Others have done that for me, and it makes a difference.

For information on how to establish a charitable gift annuity or other planned giving opportunities, contact Beri Eisenhardt, senior director of development, at beisenhardt@csudh.edu or (310) 243-3156.

– Laurie McLaughlin