Students from the Accounting Society at California State University, Dominguez Hills (CSUDH) were among the knowledgeable volunteers helping hundreds of individuals and families who converged on campus Feb. 13 to take advantage of the Free Income Tax Preparation and Family Resource Fair.

The Accounting Society partnered with the California State Board of Equalization (BOE) to host the fair in CSUDH’s Claudia Hampton Lecture Hall. As the participants entered the hall, BOE staff checked to ensure participants brought the proper documents and information with them to file their taxes during in-take interviews, while the students sat down with them in the adjoining computer lab to help them through the filing process.

The experience will prove vital for the Accounting Society as it launches its own Volunteer Income Tax Assistance (VITA) program this tax season.

“The Accounting Society believes it’s really important to give back to the community. That’s our main focus today [at the fair] and with our new VITA program,” said Alyssa Nyugen, CSUDH accounting student and this semester’s VITA coordinator. “I think a lot of people who file taxes don’t realize how much money they can get back each year if they prepare their taxes properly. I’d like to know if I wasn’t getting all the deductions or exemptions that I could.”

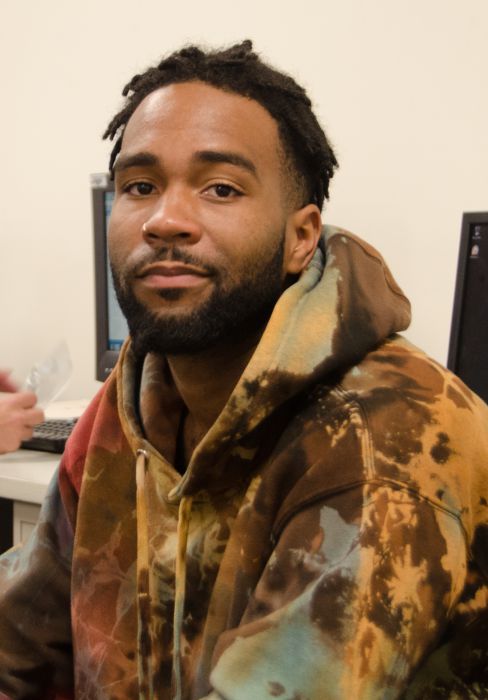

Rickey Gipson, an Inglewood resident who was aided by CSUDH students at the tax fair, has also utilized the student-run VITA program at CSU Long Beach. He looks forward to coming to CSUDH’s VITA program next year.

“I’m only 25, so I’m learning more and more about how to get back more money each year, and about filing taxes in general,” said Gipson. “It’s a learning experience for me, and of course, the free service is great. They know all the tax tricks and rules that help you get back more.”

The Accounting Society’s VITA program will resemble similar programs at other universities, as well as the BOE’s well-established tax preparation and resource fair. However, as a new program with limited resources and staff, CSUDH’s VITA program will not accept walk-ins and require tax filers to make appointments to “keep things less hectic,” according to Nyugen, particularly during its launch year.

The 2016 CSUDH VITA program will take place three days on campus: Feb. 27 and March 4-5, from 10 a.m. to 2 p.m. To register to file your taxes through the program, and for more information, please call Summer Hill at (714) 244-7539.

The VITA program at CSUDH will offer free income tax preparation for the campus community and the general public to those with incomes of $54,000 or less. The students will also help tax filers take advantage many of the new programs availed to them, such as rule changes to the Earned Income Tax Credit (EITC), and discover if they qualify for up to $6,242 through the federal EITC and up to $2,653 through the new California EITC.

Summer Hill, an accounting major who will graduate this spring, began to develop the VITA program last year.

“When I took over last year in January it was a little too late to get it [VITA] up a going for that tax season. This year I’m helping train Alyssa, and she’s doing great,” said Hill, who is serving as VITA’s co-coordinator this year. “I look forward to the program’s launch. It will be really great for the community because some of these people and families are pretty close to poverty, so getting them all the money back on their returns that they deserve will make all the difference in the world for them.”

Nyugen believes that CSUDH has a “great” accounting curriculum, and appreciates how its faculty emphasize involvement from all its students on projects such as VITA. She is particularly grateful to Alice Shiotsugu, an adjunct accounting professor at CSUDH, who has volunteered “countless hours” helping the students build the VITA program and prepare it for launch.

“We’re hoping to establish our VITA site on campus and grow our volunteers. Hopefully, we can get a VITA class for credit going at Cal State Dominguez Hills in the future,” said Nyugen. “Currently, we rely on self-teaching and wonderful professors, like Alice Shiotsugu, volunteering their time. A [for-credit] class would also give more students incentive to participate in the program.”

Hill concurs with Nyugen about the need for a tax preparation program and class at CSUDH for several reasons, and three in particular: to help families and individuals in the communities the university serves; to help CSUDH’s Accounting, Finance, and Economics Department be on par with other universities in the region that offer VITA programs; and to provide students experience doing the exact same work they will do in the workforce.

“When we get jobs we will really know what we are doing,” said Hill. “The trial-and-error happens here instead of at our future jobs. After college, we’ll be like turnkey employees to some extent.”

Items tax filers may need to bring to the VITA program:

- Proof of identification (photo ID)

- Social Security cards for you, your spouse and dependents

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a social security number

- Proof of foreign status, if applying for an ITIN

- Birth dates for you, your spouse and dependents on the tax return

- Wage and earning statements (Form W-2, W-2G, 1099-R, 1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- All Forms 1095, Health Insurance Statements

- Health Insurance Exemption Certificate, if received

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a blank check

- To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

- Total paid for daycare provider and the daycare provider’s tax identifying number such as their

- Social Security number or business Employer Identification Number

- Forms 1095-A, B or C, Affordable Health Care Statements

- Copies of income transcripts from IRS and state, if applicable